But criminals appear to be well aware of the loophole. After the puppy scammer steered Kincaid to Zelle, the representative from the fake transportation company had her use a PayPal Friends and Family account linked to her credit card.

Those accounts, which are designed to send money to individuals, not merchants, are also processed instantaneously and may only offer fraud protection in certain circumstances. A traditional PayPal account processes funds more like a credit card, so it routinely offers protection.

A PayPal spokesperson, Bernadette Guastini, says the company offers robust purchase protection for all eligible purchases.

“Nonetheless, we encourage customers to always be vigilant online, to thoroughly research the merchants they are buying from, and to only use the Friends and Family payment option for its intended purpose–as a means for friends and family members to send funds for personal matters where no goods or services are being exchanged for payment,” she explains.

After contacting her bank, Kincaid says she was able to recoup the $900 she paid with her Friends and Family account. But she wasn't able to get any of the $600 she paid with Zelle.

A recent report from Javelin, a fraud tracking and prevention firm, found that P2P fraud has jumped a whopping 733% since 2016.

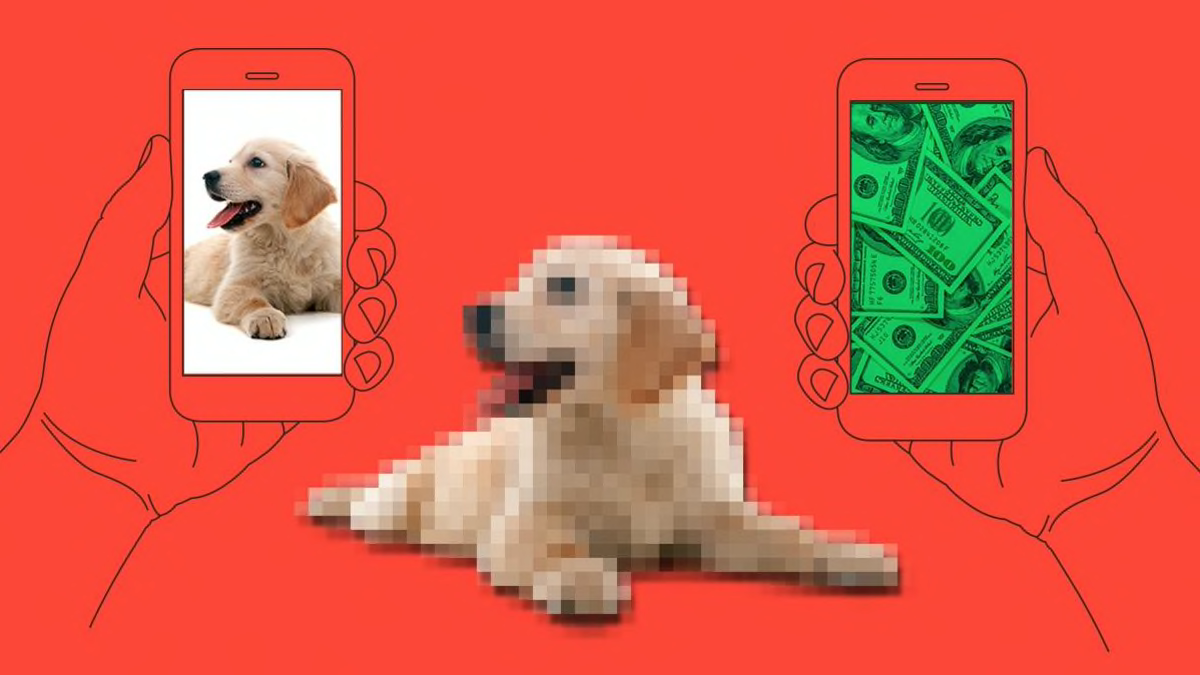

The scams run the gamut from ticket sales to offers for employment. But pet scams are among the most popular, especially as quarantined people look for “COVID puppies” to brighten their homes. There are hundreds of pet-scam complaints posted on the Better Business Bureau’s “Scam Tracker” website, with new ones appearing almost daily.

Jim Skaife and his wife, who live in Arcadia, Calif., were scammed out of $650 when they used their Zelle account to purchase a nonexistent Chihuahua puppy. “We reached out to Zelle,” he says, “and they said, ‘We'll log it and look into it, but we can't get you your money back.’ ”

Melissa Hern of Willow Springs, Mo., used CashApp to pay a $150 deposit for what she thought was an apple-head Chihuahua puppy advertised on Facebook. She also had no luck getting a full refund.

“I emailed CashApp through their online links; clicked every single link I could get hold of that day,” she says. She also called an 800 number listed on the company’s website only to be directed back to the app to file a complaint. “So I went back and did it again, and I never heard anything back from them.”

"payment" - Google News

January 09, 2021 at 06:44AM

https://ift.tt/3saeRKm

Why P2P Payment Apps Aren't as Safe as Credit Cards - ConsumerReports.org

"payment" - Google News

https://ift.tt/3bV4HFe

https://ift.tt/2VYfp89

Bagikan Berita Ini

0 Response to "Why P2P Payment Apps Aren't as Safe as Credit Cards - ConsumerReports.org"

Post a Comment