The Affordable Care Act (ACA) established a quality bonus program (QBP) that increased payments to Medicare Advantage plans based on a five-star rating system. The goal of the program is to encourage plans to compete for enrollees based on quality. In recent years, the Medicare Payment Advisory Commission (MedPAC) has raised concerns that the QBP includes too many measures, does not adequately account for social risk factors, and may not be a useful indicator of quality for beneficiaries because star ratings are reported at the contract rather than the plan level. Most Medicare Advantage contracts include multiple plans, which may have different benefits and serve different geographic areas. Given these concerns, MedPAC has recommended replacing the current approach with an alternative Medicare Advantage value incentive program (MA-VIP), which would include a small set of quality measures, evaluate plan quality at the local level, and stratify plans by enrollee characteristics when making comparisons, among other changes. Others have questioned whether the QBP may inadvertently exacerbate racial disparities, without leading to improvements in quality.

As a backdrop to these policy discussion, this analysis examines trends in bonus payments to Medicare Advantage plans, enrollment in plans in bonus status, and how these measures vary across plan types and firms, using publicly available on Medicare Advantage enrollment, payment rates, and quality ratings.

We find:

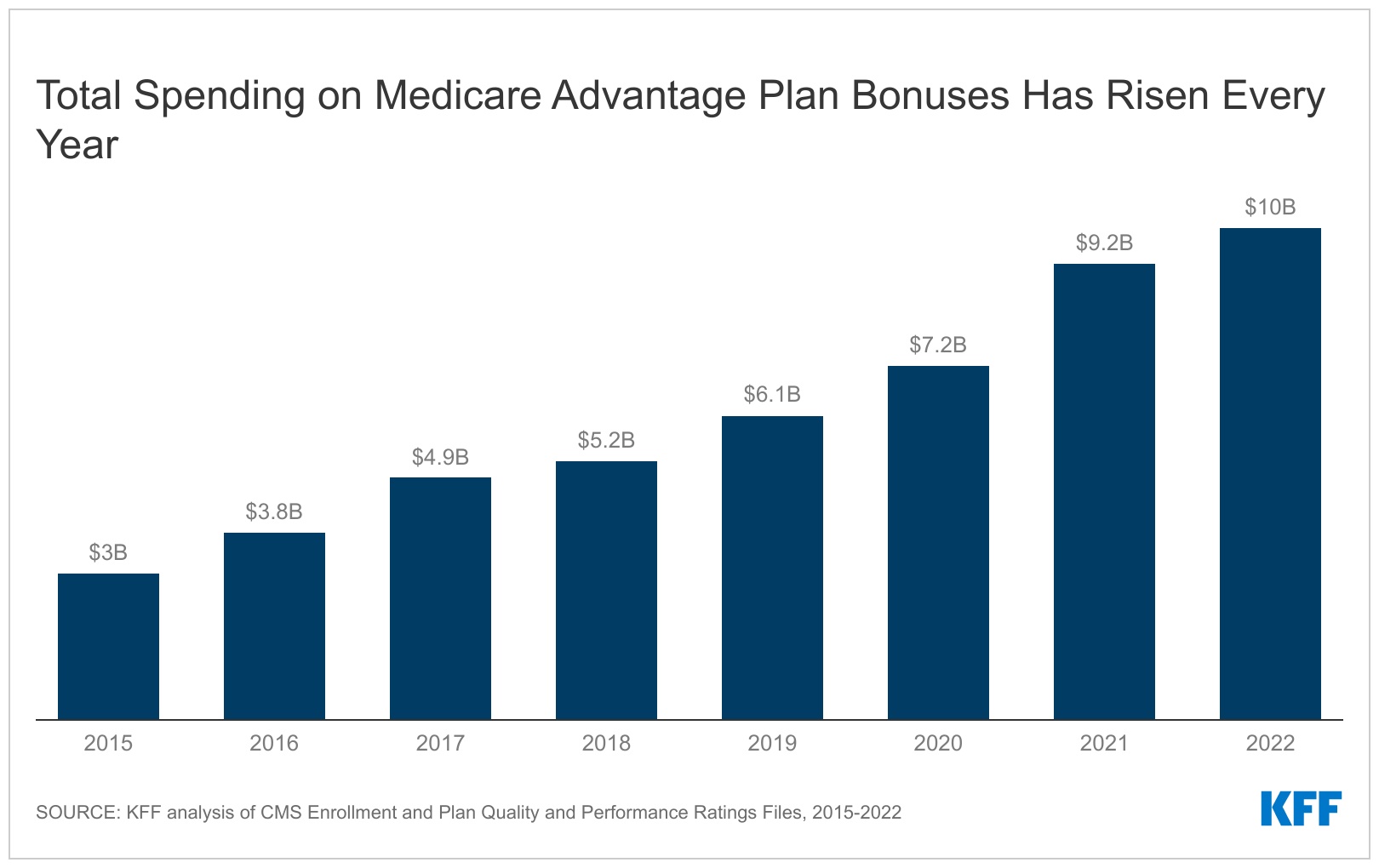

- Federal spending on Medicare Advantage bonus payments has increased every year since 2015 and will reach at least $10 billion in 2022.

- The majority of Medicare Advantage enrollees (75%) are in plans that are receiving bonus payments in 2022.

- The average bonus payment per enrollee is highest for Medicare beneficiaries in employer sponsored plans ($396) and lowest for those enrolled in special needs plans ($278).

- Bonus payments vary substantially across firms, with UnitedHealthcare receiving the largest total payments ($2.8 billion) and Kaiser Permanente receiving the highest payment per enrollee ($521).

Background on the Medicare Advantage Quality Bonus Program

A key feature of the quality bonus program is the star rating system. As a result of the Affordable Care Act, star ratings are used to determine two parts of a plan’s payment: (1) whether the plan is eligible for a bonus, and (2) the portion of the difference between the benchmark and the plan’s bid. The benchmark is the maximum amount the federal government will pay for a Medicare Advantage enrollee and is a percentage of estimated spending in traditional Medicare in the same county, ranging from 95 percent in high-cost counties to 115 percent is low-cost counties. The bid is the plan’s estimated cost for providing services covered under Medicare Parts A and B.

Plans that receive at least four (out of five) stars have their benchmark increased. For most plans that are in bonus status, the benchmark is increased by five percent, while plans in double bonus counties (urban counties with low traditional Medicare spending and historically high Medicare Advantage enrollment) have their benchmark increased by 10 percent. In addition, the benchmark for plans without ratings due to low enrollment or being too new is increased by 3.5 percent. The benchmarks are capped and cannot be higher than they would have been prior to the ACA. This can result in plans that are eligible under the quality bonus program receiving a smaller increase to their benchmark, or in some cases, no increase at all.

Findings

Quality bonus program spending

Medicare Advantage plans will receive an estimated $10.0 billion in bonus payments in 2022, more than triple the amount in 2015 ($3.0 billion) (Figure 1). These estimates are a lower bound because actual bonus payments are risk adjusted, which we expect to increase bonus payments. Additionally, we do not account for the possibility that some plans may increase their bids when their benchmark is higher as a result of the quality bonus program, rather than using the higher payments to fund extra benefits. A plan might increase its bid to increase payments to providers, including adding more expensive providers to its network, or to retain a larger amount as profit, provided they meet medical loss ratio requirements. This would lead to even higher Medicare Advantage spending.

The distribution of bonus spending across plan types is similar to the distribution of enrollment in 2022. Individual plans account for 67% ($6.7 billion), employer plans account for 20% ($2.0 billion), and special needs plans account for 13% ($1.3 billion) of bonus spending in 2022 (Figure 2). (Some employers contract with private insurers to provide health coverage to their retirees through a Medicare Advantage plan.)

Enrollment in plans in bonus status

The growth in spending on bonus payments over time follows an increase in Medicare Advantage enrollment generally, as well as a rise in the share of enrollees in plans that receive bonuses. In 2022, three-quarters (75%) of Medicare Advantage enrollees, or 21.3 million people, were in plans that received bonuses, compared to just over half (55%) of Medicare Advantage enrollees in 2015, or 8.9 million people (Figure 3). The share of enrollees in plans that receive bonus payments in 2022 is somewhat smaller than the previous year (80%), though the absolute number is still higher (20.7 million Medicare Advantage enrollees were in plans that received a bonus payment in 2021). The decrease reflects a decline in average star ratings between the 2020 and 2021 plan years.

Average bonus payments per enrollee

The average annual bonus per Medicare Advantage enrollee has also increased over time, rising from $184 in 2015 to $352 in 2022. Average bonuses in employer plans have consistently been higher than for other plans due to higher average star rating. The average bonus per enrollee in a group employer/union sponsored Medicare Advantage plan is $396 in 2022, compared to $358 for individual plans and $278 for special needs plans (SNPs). There has been some fluctuation year-to-year, with the average bonus payment for employer plans and SNPs falling slightly in 2022 compared to the previous year (Figure 4).

Bonus payments by firm

Total bonus payments by firm largely tracks the distribution of Medicare Advantage enrollment. UnitedHealthcare and Humana, which together account for 46% of Medicare Advantage enrollment, have bonus payments of $4.7 billion (47% of total bonus payments) in 2022 (Figure 5). CVS Health and BCBS affiliates (including Anthem BCBS) will receive $1.2 and $1.1 billion in bonus payments, respectively, followed by Kaiser Permanente ($0.9 billion), Cigna and Centene ($0.2 billion each).

The average bonus per enrollee ranges from $174 for beneficiaries in Centene plans to $521 for those in Kaiser Permanente plans. The variation in total bonus payments across firms corresponds to differences in the share of enrollees in plans that receive bonuses. Virtually all enrollees in a Kaiser Permanente plan (99%) are in a plan that receives bonus payments because it has a quality rating of at least four stars, while just 41% of Centene enrollees are in a plan receives bonus payments in 2022.

Discussion

In 2022, annual bonus payments from the federal government to Medicare Advantage insurers have reached $10 billion at a time when the Medicare program is facing growing fiscal pressures. Notably, the average bonus per enrollee varies across types of plans and has historically been lowest for special needs plans and highest for group sponsored employer/union plans. Relatively low bonus payments for special needs plans, which enroll higher need and more vulnerable beneficiaries, and higher bonus payments for employer plans that tend to provide retiree health benefits to higher income beneficiaries, raise potential concerns about the consequences of the quality bonus program for equity.

Quality indicators for Medicare Advantage were established to help consumers make informed decisions when choosing among Medicare Advantage plans and encourage plans to compete based on quality. However, the Medicare Payment Advisory Commission (MedPAC) and others have raised questions about the methodology currently used to measure the quality of Medicare Advantage plans, including whether the quality bonus program has led to improvements in plan quality. Understanding the implications of the quality rating system and associated bonus payments, including the related costs to Medicare and taxpayers, will be increasingly important as Medicare Advantage enrollment continues to climb.

Jeannie Fuglesten Biniek, Meredith Freed, and Tricia Neuman are with KFF.

Anthony Damico is an independent consultant.

This work was supported in part by Arnold Ventures. KFF maintains full editorial control over all of its policy analysis, polling, and journalism activities.

| This analysis uses data from the Centers for Medicare & Medicaid Services (CMS) Medicare Advantage Enrollment, Crosswalk and Landscape files for the respective year.

This analysis includes HMO, POS, local PPO, regional PPO, and PFFS plans. Enrollment counts in publications by firms operating in the Medicare Advantage market, such as company financial statements, might differ from KFF estimates due to inclusion or exclusion of certain plan types, such as SNPs or employer plans. To calculate federal spending on quality bonus program payments we first obtained information on star ratings from the Part C and Part D Performance Data, Star Ratings Data Table for the previous plan year. These are the ratings on which a plan’s benchmark is based. We then determined each plan’s benchmark using these data and information from the Medicare Advantage Rate Book, Rate Calculation Data, which provides the benchmark by county for plans with a 5%, 3.5% and 0% bonus. A plan’s bonus payment per enrollee is equal to the difference between its quality adjusted benchmark (either the 5% or 3.5% bonus rate) and the benchmark if the plan was not in bonus (0% bonus rate), multiplied by the relevant percentage based on its star rating and year (for example, 65% for plans with 4 stars and 70% for plans with at least 4.5 stars in 2022). The bonus per enrollee is multiplied by enrollees in March of each year to get total spending. Actual bonus payments will depend on the risk scores of Medicare Advantage enrollees. According to the plan payment data release by CMS, the average risk score of MA enrollees was above 1 for every year from 2015 through 2019 (the most recent year for which data are available), meaning our estimates likely understate actual spending. This analysis differs from prior analyses because we made a correction to the methodology that affects the calculation of the bonus payment for group plans. Previously, our calculations captured the full rebate payment, rather than the bonus payment portion, which overstated the bonus payments for employer plans. |

"payment" - Google News

August 25, 2022 at 04:04PM

https://ift.tt/KmcbDEF

Spending on Medicare Advantage Quality Bonus Program Payment Reached $10 Billion in 2022 - Kaiser Family Foundation

"payment" - Google News

https://ift.tt/YLOaMNg

https://ift.tt/sd8tyk9

Bagikan Berita Ini

0 Response to "Spending on Medicare Advantage Quality Bonus Program Payment Reached $10 Billion in 2022 - Kaiser Family Foundation"

Post a Comment