The COVID-19 pandemic has significantly accelerated the volume and value of digital payments, in 2022 we will see the next phase of digital payments as alternative payment methods become the norm. Buy now, pay later (BNPL), digital wallets, and account-to-account (A2A) payments will continue to eat share of traditional payment methods such as card and cash thanks largely to new real-time payment rails being activated and a maturing open banking infrastructure that lays the foundations for a shift in payments behavior.

RTP Infrastructure Enables Next-Level Payments to Emerge in 2022

Real-time payments have long been seen as a gamechanger for payment services, but the implementation of ISO 20022, open banking maturity, and a regulatory drive will see payment services such as request to pay (R2P), variable recurring payments (VRP), and A2A payments grow in familiarity for the consumer in 2022. The demand for instant payments is mounting from both a consumer and a business perspective, with settlement expected to occur in real time, which is reflected in more and more mid-to-low-tier banks deploying payment hubs to access real-time payment rails.

Globally, real-time payment rails continue to gain traction: Brazil’s PIX network processed more than 1 billion transactions within its first year of operation and accounted for 78% of nationwide bank transfers within its first two months of launch. Nordic’s P27 network is expected to go live in 2022, shortly followed by the US FedNow service in early 2023. Use cases being built on real-time payment rails are expanding, according to Omdia’s survey with Payment Issuers/Acquirers, with almost 40% of respondents deeming it a top priority for retail payments, with A2A payments, R2P, and VRP being seen as having the highest potential for consumer and merchant adoption.

Alternative Payments Are Shifting to the Mainstream

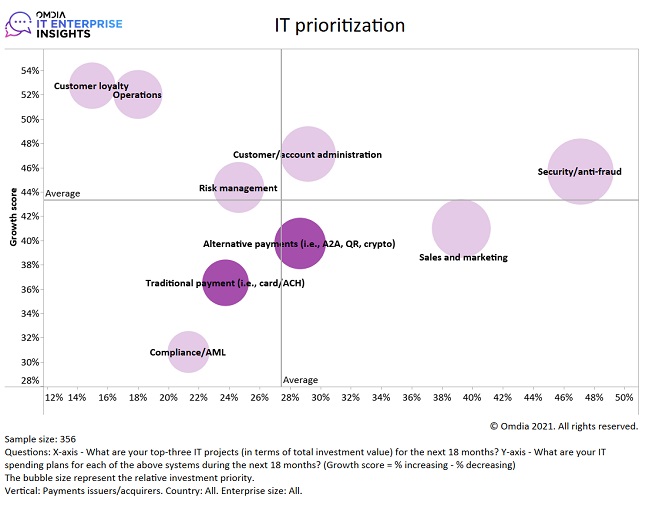

Traditional payments are increasingly less important for technology executives: fewer than a quarter of respondents in Omdia’s survey selecting traditional payments in their top three IT projects, while a third of respondents selected alternative payments as a top priority. Similarly, spending on technology in alternative payments is expected to outgrow traditional payments significantly over the next 18 months as issuers and acquirers adapt to an unprecedented demand for digital payments.

Merchants are actively adopting alternative payments with A2A payments, digital wallets, and buy now, pay later increasingly visible alongside card networks and traditional automated clearing house (ACH) payments at checkouts. Some merchants are seeking to restrict certain traditional payments: Amazon has announced it will no longer accept Visa credit cards in the UK from 2022 in response to the interchange fee rising from 0.3% to 1.5% following the UK’s exit from the EU. Open banking payments, such as A2A, will likely benefit in 2022 from the rising processing costs of card payments, and other merchants may follow Amazon’s initiative.

The payments industry has also recognized cryptocurrency is far more than a fad or a meme, 2021 was its breakout year. Bitcoin has hit all-time highs multiple times, almost all the incumbents are starting to recognize crypto as much more than just a fad or meme, and every tech company is hiring a cryptocurrency team from Twitter to Bumble. Now, Governments are engaging in crypto, too, through the exploration of central bank digital currency, also known as CBDC. China is expected to officially unveil its CBDC -- digital yuan -- during the Winter Olympics in early 2022 and Meta’s Diem project is also due for launch in 2022 and will accelerate the wider adoption of crypto.

Embedded Payments Is the New Expectation at the Checkout

Buy now, pay later (BNPL) has redefined the relationship consumers have with credit as they make their financial decisions at the checkout. BNPL is threatening the traditional credit card payment models and forces banks to either launch their own BNPL service or partner with an existing provider to maintain a direct relationship with their own customers. Almost half the merchants surveyed by Omdia stated that the biggest improvement to reduce friction in digital payments would be improving integration with their payment gateway. This could be achieved through embedding payments in the checkout journey on a universal level, similar to the user experience that is expected when ordering through Uber or Deliveroo. Embedding the payment is about not just ensuring a seamless user experience but also about harnessing customer data to present the consumer with relevant, personalized financing options at the point of purchase to reduce friction.

In 2022, embedded payments will be driven at merchant-level and expect the likes of Amazon, Walmart, and Starbucks to reward loyalty with favorable payment terms at the checkout, which minimize processing costs for the retailer whilst ensuring a frictionless purchase journey.

"payment" - Google News

December 21, 2021 at 07:00PM

https://ift.tt/3EnzMik

Payment Trends to Watch in 2022 - InformationWeek

"payment" - Google News

https://ift.tt/3bV4HFe

https://ift.tt/2VYfp89

Bagikan Berita Ini

0 Response to "Payment Trends to Watch in 2022 - InformationWeek"

Post a Comment