Susan Morse of San Francisco filed her 2019 taxes in late February and was due “a good size refund,” she said. More than three months later, she’s still waiting for a check.

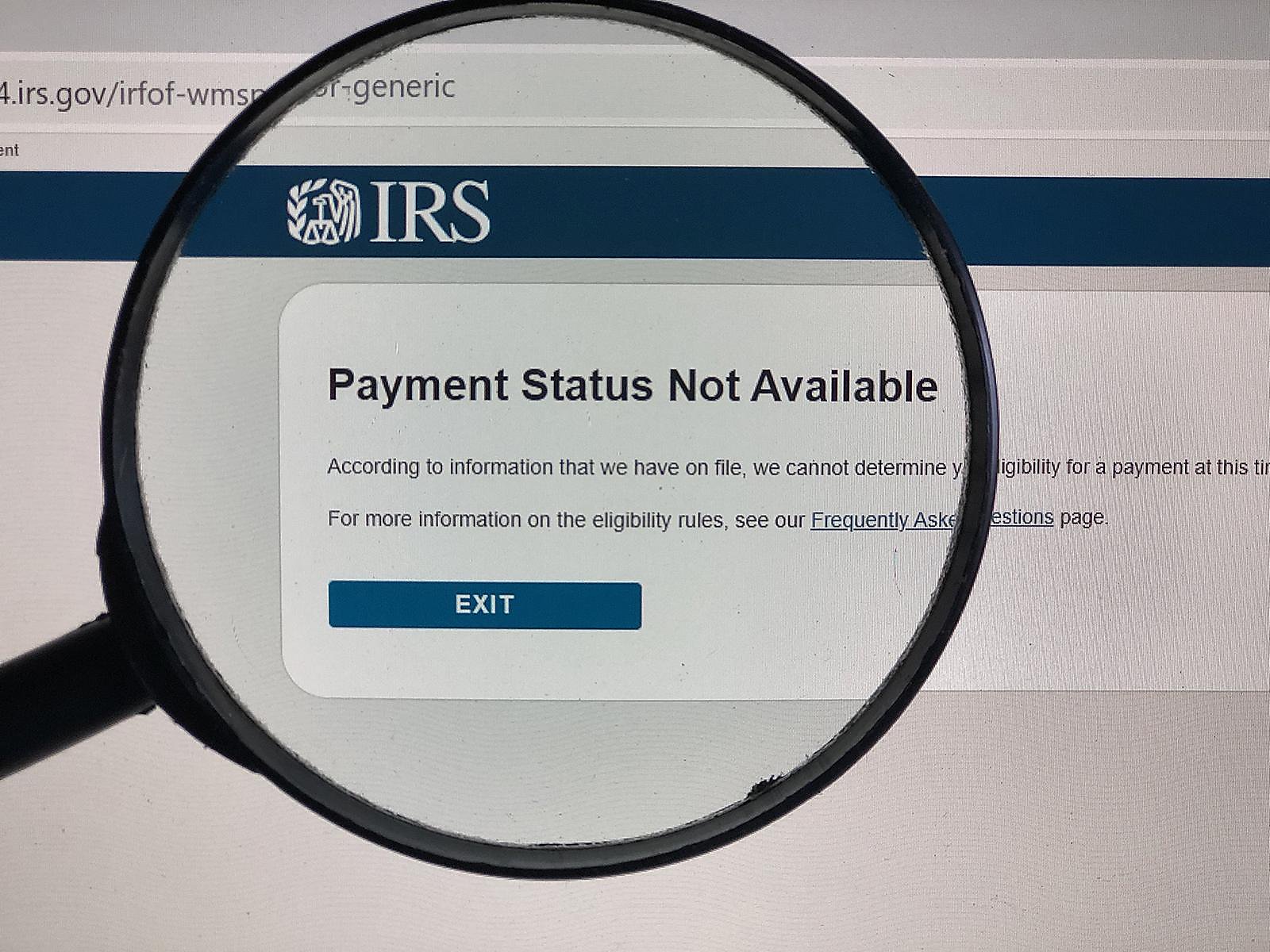

“Unfortunately, I filed it via paper with the request for a paper check back my way. I check the IRS Where’s My Refund website daily and keep getting the same response — ‘it’s being processed,’” she said. “There is no way to reach anyone at the IRS right now as I have tried various numbers and get the answer that no agents (are) available — go to the website. I could file again electronically and ask for a refund to be deposited into my bank account, but I don’t want the IRS to see two filings that are the same with different methods of paying the taxpayer.”

She added that she filed her California return on paper and got her refund “a while ago.”

Morse is not alone; I’ve gotten many such emails in the past month, including one from Bob Butler of Half Moon Bay. He filed by mail March 15 and is awaiting his refund. He too has tried the IRS website, phone number and called the National Taxpayer Advocate’s office many times, to no avail.

The U.S. Treasury Department and Internal Revenue Service are proud of the fact that they have issued 159 million stimulus payments since April. They even set up a phone line just for stimulus payment questions. But people who requested, via snail mail, a refund of taxes they paid in 2019 have been left in the lurch. Even some who filed electronically are still waiting.

“In many instances the refunds on the returns are much higher than the economic impact payments,” said Nina Olson, the former IRS National Taxpayer Advocate and now executive director of the Center for Taxpayer Rights.

By late March or early April, the IRS had shut down taxpayer assistance centers, its volunteer tax-preparation program, most of its return-professing centers and its customer service phone lines.

“The IRS had tried keeping its Ogden, Utah, facility open so it could continue to process paper returns,” but announced in mid-April it was closing that, too, Olson said in an email.

Also in mid-April, IRS Deputy Commissioner Sunita Lough explained in several webcasts that all mail sent to the IRS was being warehoused in trailers.

IRS spokesman Raphael Tulino urged taxpayers not to file twice, “as it will only delay things even further.”

The IRS recently reopened its customer service line at 800-829-1040 but warns that it’s “extremely limited.”

On Wednesday, IRS Commissioner Chuck Rettig announced that the agency had started calling back employees with “nonportable” work to campuses in Kentucky, Texas and Utah on June 8. It will begin to reopen operations in Georgia, Tennessee, Missouri and Michigan in the week of June 15; Indiana and Ohio beginning June 29; and California, Puerto Rico, Oregon beginning June 29. These include “key processing centers, notice print facilities and call center operations. We will continue to focus on nonportable work,” he said in the announcement.

However, “it is going to take them a while to get through the huge backlog,” Olson warned. “This is why IRS employees should have been declared ‘essential workers,’ so the government would have figured out a way to get the workspace safe, give the employees the proper protective clothing.”

For the week ended May 29, the IRS had processed about 121.2 million returns, down 13.3% compared to the same time last year. The number received was 133.8 million, down 6.5%. About 90% of returns filed came in electronically; of those the number processed was 6.3% behind last year’s level. The IRS has delayed its 2019 tax filing deadline until July 15.

Olson added that “many e-filed refunds are being held up because the returns were flagged” because of earned income tax credit, identity theft or non-identity theft fraud filters, “and there was no one at the IRS to look at the return and resolve the issue.”

“I don’t understand why IRS employees can’t work these return issues from home; they aren’t paper, they are electronic, and at least some employees and analysts and managers have remote access to the system,” she said.

For the week ended May 29, the IRS had processed about 121.2 million returns, down 13.3% compared to the same time last year. The number received was 133.8 million, down 6.5%. About 90% of returns filed came in electronically; of those the number processed was 6.3% behind last year’s level.

Year-over-year comparisons are somewhat difficult because the IRS and the California Franchise Tax Board have delayed their 2019 tax filing deadline until July 15.

In California, state tax returns are processed at a central office in Sacramento, “which has remained open during COVID-19,” Franchise Tax Board spokesman Daniel Tahara said in an email. By the end of May, it had issued nearly 10 million refunds, compared to 11.6 million this time last year.

For taxpayers who filed electronically and requested refunds via direct deposit, the processing time can be up to three weeks. For paper returns and paper refund checks, the processing time can take up to three months, Tahara said.

In previous years “we were saying two to three weeks for e-filed returns and two to three months for paper returns.”

The processing times for tax returns with payments appear to be consistent with previous years as well.

“Electronic payments can take up to five business days, credit card up to seven business days, and paper checks up to 14 business days,” Tahara said.

Kathleen Pender is a San Francisco Chronicle columnist. Email: kpender@sfchronicle.com Twitter: @kathpender

"payment" - Google News

June 09, 2020 at 08:15AM

https://ift.tt/2XLFzvG

Forget stimulus payments. Many are asking the IRS, 'Where's my refund?' - San Francisco Chronicle

"payment" - Google News

https://ift.tt/3bV4HFe

https://ift.tt/2VYfp89

Bagikan Berita Ini

0 Response to "Forget stimulus payments. Many are asking the IRS, 'Where's my refund?' - San Francisco Chronicle"

Post a Comment