I. Introduction

The Regulation on the Generation and Use of TR QR Code in Payment Services (“Regulation”) including its annex TR QR Code Rules and Principles (“Technical Document”) prepared by the Central Bank of the Turkish Republic ("Bank") as part of the same initiatives have entered into force following their publication in the Official Gazette No. 31220 dated 21 August 2020.

II. QR Code in General

QR code, also known as Data Matrix, is defined as two-dimensional code that created to be used in payment transactions by scanning method, stores alphanumeric data, characters and symbols, consisting of three square pattern markers on the lower left corner, upper left corner and upper right corner, and having black and white modules in the form of square black-and-white dots or pixels. QR code has a field to provide the necessary information such as identity, account and card information of one of the parties in a payment transaction. QR code is shown by one of the parties of the transaction and scanned by the other during the execution of the payment transaction. QR code examples are as follows:

III. TR QR CODE

In the press release numbered 2020-52 published by the Bank, it was announced that the national rules and principles for the standardized “TR QR Code” aim to enhance the use of a common QR code in retail payments, initiate practical, easier, more efficient and safer payments, and thus help to reduce the use of physical cash in the form of banknotes. TR QR Code, therefore, will be required to be used in payments by using QR code, which is one of the payment services within the scope of the Law on Payment and Securities Settlement Systems, Payment Services and Electronic Money Institutions No. 6493 (“Law”). In this context, the Regulation and the Technical Document bring important innovations as follows:

- TR QR Code payments,

- Generation of TR QR Code and Generator Code

- Technical Principles and Rules Guide

- QR Code Switch and National Business Registration System

- Parties, powers and responsibilities

- Transactions involving foreign elements

1. TR QR Code payments

TR QR Code will be used in every payment transaction that is within the scope of payment services where QR code is using. The followings as mobile payments, bill payments, online payments and physical POS payments are within the scope of the payment service:

- All the transactions required for operating a payment account including the services enabling cash to be placed on and withdrawn from a payment account

- Execution of payment transactions, including transfers of funds on a payment account with the user’s payment service provider, direct debits, including one-off direct debits, payment transactions through a payment card or a similar device, credit transfers including standing orders

- Issuing or acquiring payment instruments

- Money remittance

- Execution of payment transaction, where the consent of the payer to execute a payment transaction is given by means of any telecommunication, digital or IT device and the payment is made to the telecommunication, IT system or network operator, acting only as an intermediary between the payment service user and the supplier of the goods and services

- Corresponding services enabling bill payments

- At the request of the payment service user, the payment initiation service related to the payment account at another payment service provider

- Upon approval of the payment service user, the online provision of consolidated information of one or more payment accounts held at payment service providers by payment service users

- Other transactions and services reaching the level to be determined by the Bank in terms of total size or impact in payments

The Bank has the authority to determine an upper limit for payment transactions to be made with TR QR Code. The Bank is also authorized to request the necessary information and documents from payment service providers, system operators, businesses, and external service providers where TR QR Code transactions are carried out, and to make on-site inspections if necessary.

QR code classes are examined according to their reusability and usage types under the Technical Document.

QR codes that support a wide variety of payment services such as e-commerce, in-store physical payments, corporate / invoice payments are divided into two classes as (i) static QR codes and (ii) dynamic QR codes according to content variability and reusability.

In the distinction according to usage methods, there are a triple distinction as (i) QR codes provided by the business, (ii) QR codes provided by the customer, and (iii) QR codes offered from person to person.

2. TR QR Code Generation and Generator Code

TR QR Code will be generated by the payment service provider having the QR Code Generator Code and by the payment system operator approved by the Bank under TR QR Code Principles and Rules. The payment service provider will be able to outsource TR QR Code generation. The QR Code Generator Code will be determined by the Interbank Card Center (“BKM”) upon the request of the payment service provider and the payment system operator priorly approved by the Bank, and will be announced on the website of Bank.

3. Technical Principles and Rules Guide

The Technical Principles and Rules Guide will be determined by the Bank upon the application of the relevant system operator. Besides, the Bank is authorized to prepare the Technical Principles and Rules Guide for the certain type of payment services which includes the workflows related to the transactions to be performed using TR QR Code if it deemed necessary for the development of the payments area.

4. QR Code Switch and National Business Registration System

BKM will establish and operate QR Code Switch System to ensure the transfer of the QR code and the information in its content between payment service providers. The payment service providers, therefore, will obtain QR Code Generator Code from BKM. The operating rules of QR Code Switch System, terms of participation and pricing principles according to the cost principle, and all related procedures and principles will be determined by the Bank and announced on the website.

National Business Registration System will be established in BKM to facilitate the processes related to payment transactions made with TR QR Code and to prevent fraud and malicious activities.

5. Parties, authorities and responsibilities

Possible parties of the payment transaction to be made with TR QR Code are specified under the Technical Document as follows:

- QR Code generators to be used for payments

- Businesses and customers that will accept the QR codes - payment service users

- Acquirer payment service providers

- Payment systems that transfer funds between payment service providers for the payments made using the QR code

- Third party service providers that set up QR code-based payment acceptance applications / systems

The authorities and responsibilities of (i) the payment service provider and (ii) the business are determined with the Regulation.

(i) The authorities and responsibilities of the payment service provider are as follows:

- To ensure the creation of a QR code per the Technical Document and to take the necessary measures for the payments with TR QR Code are made safely

- To be able to set an upper limit for payment transactions to be made using TR QR Code, provided that it does not exceed the upper limit for payment transactions that can be brought by the Bank

- To ensure the quality and readability of TR QR Code are high as much as possible and to ensure the integrity of TR QR Code

- To ensure the payments to be made with TR QR Code are made in compliance with the information on the QR code, and to ensure that the integrity of the information contained in the QR code is protected while the payment is being processed

- To take the necessary measures to protect the physical security and readability of TR QR Code in payment transactions where the static QR Code is used, and to include the necessary provisions in the framework agreement regarding the necessary measures to be taken by the business

- To comply with the provisions regarding the use of external services in the legislation to which the payment service provider is subject in case of receiving external services for the generation of the QR code

- To inform the parties by appropriate methods such as phone, text message or application, that the payment transaction has been made.

(ii) The responsibilities of the business are as follows:

- To inform the payment service users that payments can be made with a QR code per with the form determined by the Bank

- To ensure that TR QR Code transactions are carried out per the information in the QR code

- To exercise due care to protect the integrity of the information on the QR code

- To take the necessary measures to protect the physical security and readability of the QR code in payment transactions using static codes

6. Transactions with foreign elements

It is not mandatory to use the TR QR Code for payment transactions made domestically and using payment instruments issued under the foreign country legislation, where one of the parties of the transaction is located abroad, and that uses the infrastructure of a payment service provider located abroad.

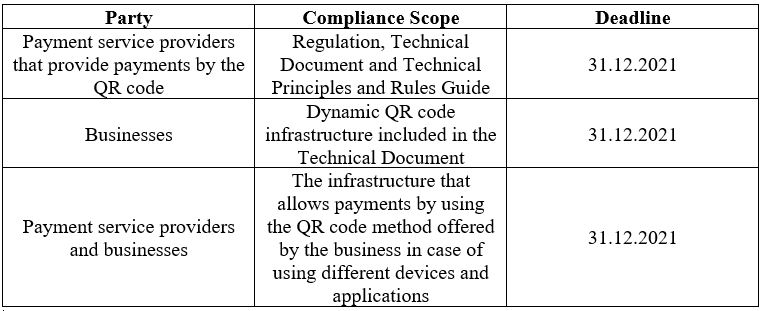

IV. COMPLIANCE PERIOD

According to the transitional provisions of the Regulation, the schedule of the compliance process is as follows;

These periods may be extended by the Bank for a period not exceeding one year.

V. CONCLUSION

Fundamental amendments had been made to the Law before and a similar approach to the European Union Payment Services Directive (PSD2) was introduced. The most important of these was the transfer of the authority of the Banking Regulation and Supervision Agency regarding payment services and electronic money to the Central Bank of the Turkish Republic.

This Regulation published for the localization of financial technologies will have a positive contribution to the Turkish Fintech ecosystem, especially the daily life of consumers.

It will be appropriate to follow the Technical Principles and Rules Guide and secondary legislation to be issued by the Central Bank of the Turkish Republic and to evaluate the secondary legislation as a whole along with the putting TR QR Code into practice.

"payment" - Google News

February 02, 2021 at 05:57PM

https://ift.tt/3ajNtl2

Turkish QR Code in Payment Services - Lexology

"payment" - Google News

https://ift.tt/3bV4HFe

https://ift.tt/2VYfp89

Bagikan Berita Ini

0 Response to "Turkish QR Code in Payment Services - Lexology"

Post a Comment