The Nifty50 started the previous week on a negative note to breach its 21-DMA on February 22. The next three sessions saw good signs of accumulation, which helped the index retake its 21-DMA.

But, on February 26, it succumbed to a massive selloff, tracking global cues. The fall was the biggest since May 4, 2020. The session qualifies as a distribution day as the volume was higher compared with the previous session.

Here are 7 secrets of successful selling to cut losses:

1 Everyone makes mistakes, just be sure to cut all losses short

Even the best investors get hit with a loss from time to time but they don’t dwell on it or wring their hands as the stock drops even lower. They cut their losses quickly and move on. So leave your ego and pride at the door, and don’t let a loss get to you—either mentally or financially.2 If you don’t sell early, you’ll sell late:

Don’t get greedy. Get disciplined! To lock in solid gains, sell while your stock is still going up. As O’Neil has said, “Your objective is to make and take significant gains and not get excited, optimistic, greedy or emotionally carried away as your stock’s advance gets stronger.”

3 Have a selling plan in place before you buy

If you’re a warm-blooded human being, you’ll find the real drama kicks in when it comes time to sell. And, if you don’t have sell rules and an exit plan to guide you, it’s easy to freeze and not take action when you need to.

If your stock is soaring higher, you may get a little greedy and want to grab every last nickel—not recognising certain sell signals that tell you it could be heading for a fall.

And if you’re sitting on a loss, you may do the old “hold and hope” routine, praying it’ll bounce back to break even while it continues to push you even deeper in the red.

So, make it easy on yourself: have a clear selling plan in place. Write down your target sell prices for both locking in your profits and nipping losses in the bud.

4 Don’t let a decent gain turn into a loss

It’s no secret that stock prices fluctuate day to day. Even if a stock is trending generally higher, it will have down days and weeks along the way. To make money, you need to sit through those swings and give the stock time to climb higher.

But, if you have a nice gain of, say, 20 percent or better, and the stock begins to trend down, don’t let that profit disappear completely. If institutional investors are clearly starting to sell, you’ll want to lock in at least some of your profits.

If the general market uptrend is also starting to run out of steam, all the more reason to cash in the gains. If you choose to hold, have a target sell price in mind.

For example, if your former 20 percent gain falls to, say, 10 percent, sell. The profit-taking price is up to you. The point is you never want to “round-trip” a stock by riding it up to a big gain and all the way back down into a loss.

It’s much less frustrating to see a 15–20 percent gain turn into a 5–10 percent profit than it is to see it turn into a 5 profit loss.

Don’t forget you can always buy back the stock if it rebounds and institutional investors start aggressively buying it again.

5 Don’t marry your stocks, just date them

“For better or for worse, for richer or for poorer” is a noble and time-honoured approach to marital fealty but a bad idea when it comes to investing. In most cases, it’s better to take a good gain while you have it, then move on to your next conquest. And never hesitate to cut yourself loose from a bad relationship if there are clear signs of trouble.

(Remember: Don’t try this at home with your significant other . . .)

6 Sell your losing stocks first

If you were trying to build a champion cricket team, would you trade your top players and keep all your benchwarmers? Of course not! Yet many investors do just that: they sell stocks in which they have a good gain—and hold on to those showing a loss, thinking a big gain is just around the corner.

That’s usually wishful thinking. To build a powerhouse portfolio, you want to do the exact opposite: sell your losers and use that money to add new winners to your roster or invest more in the top performers you already own.7 Focus on fundamentals, chart action

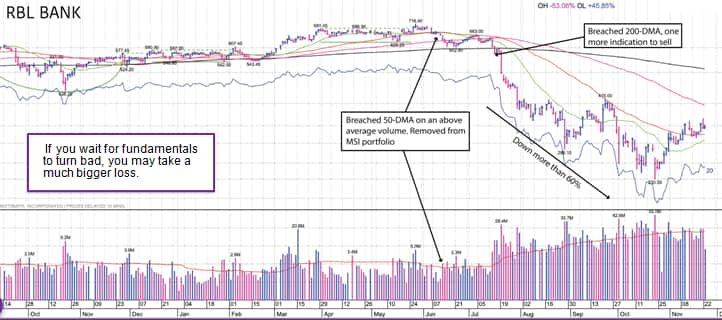

While buying a stock, focus on fundamentals and the chart action. When selling, focus on the chart action.

They say the view from the top is great and that often applies to stocks as well. Market leaders will often still be posting stellar earnings and sales growth even as the stock begins to decline.

That’s because warning signs typically show up in the chart before they appear in the fundamentals (ie, earnings, sales and other company-related criteria). It could be that institutional investors see trouble ahead and are starting to take their profits, or the overall market may be weakening.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

"selling" - Google News

March 01, 2021 at 09:54AM

https://ift.tt/37U8S4c

Everyone makes mistakes, remember these 7 secrets of successful selling - Moneycontrol.com

"selling" - Google News

https://ift.tt/2QuLHow

https://ift.tt/2VYfp89

Bagikan Berita Ini

0 Response to "Everyone makes mistakes, remember these 7 secrets of successful selling - Moneycontrol.com"

Post a Comment