The fallout of the prolonged Arctic freeze that’s draped over the central United States and into Texas is still unfolding, with a temporary ban on gas exports out of the Lone Star State the latest development in the ongoing crisis.

Hours before the surprising announcement, steep decreases in production and large swings in demand fueled Nymex gas futures prices for a second day. Facing what potentially could be the largest storage withdrawal of the winter so far, the March Nymex natural gas futures contract settled Wednesday at $3.219, up 9.0 cents from Tuesday’s close. April picked up 4.9 cents to $3.032.

Action in the cash markets remained volatile midweek as Oklahoma added another digit to next-day prices, while prices in other parts of the country also started to tack on more meaningful gains than in recent days. However, other areas tumbled in dramatic fashion, helping to send NGI’s Spot Gas National Avg. down $40.135 to $40.625.

The energy crisis in Texas is far from contained, with additional prolonged power outages implemented across the state early Wednesday as temperatures remained not far above freezing. The state’s electric grid operator, the Electric Reliability Council of Texas, said some 185 generating units have tripped offline for one reason or another amid the unprecedented freeze. Until more generation comes back online, power restoration efforts would be hampered.

In a media address on Wednesday afternoon, Texas Gov. Greg Abbott noted that some natural gas produced in Texas is currently being shipped to locations outside of the state. In response, the governor issued an order prohibiting those producers from transporting that natural gas beyond state lines.

“I have, earlier today [Wednesday], issued an order effective today through Feb. 21 requiring those producers that have been shipping to locations outside of Texas to instead sell that natural gas to Texas power generators,” Abbott said. “That will increase the ability of gas power generators in Texas to increase power sent to the Texas power grid.”

In addition, Abbott said that President Biden has assisted Texas with orders that “allow additional power generation or have accelerated nuclear plant restoration.”

Still In the Dark

In Texas, some 28,000 MW of thermal generation has been forced off the system during the extreme weather event, according to ERCOT. Another 18,000 MW of wind and solar also have been kicked off the grid.

Overnight, ERCOT was able to restore around 3,500 MW of load, which is roughly 700,000 households. However, some of that was lost when the Midwest went into a power emergency of its own, and the grid operator was no longer able to import around 600 MW. As of 9 a.m. CT, ERCOT instructed local utilities to shed 14,000 MW of load representing around 2.8 million households.

“The ability to restore more power is contingent on more generation coming back online,” said ERCOT Senior Director of System Operations Dan Woodfin.

Since the winter storm began on Monday, frozen wind turbines, limited gas supplies, low gas pressure and frozen instrumentation cut into generation.

EBW Analytics Group said ERCOT largely abandoned the use of rolling blackouts, instead leaving a large portion of the state without power, fearing that the grid might collapse if more stress were put on the system. “ERCOT’s CEO estimated that if the grid collapses, it might take a month to restore power,” EBW analysts said.

The Southwest Power Pool also continued to operate under an emergency order, urging homes and businesses throughout its 14-state region in the central United States to conserve electricity. However, as of Wednesday afternoon, it was not directing any interruptions of service.

The disorder in Texas sent next-day gas prices in part of Texas as high as $500.000 midweek. However, Waha in the Permian Basin topped out at $90.000 and averaged $64.215, down $141.975 from Tuesday’s levels.

In neighboring Oklahoma, gas prices continued to skyrocket.

OGT, otherwise known as Oneok Gas Transmission, next-day gas traded as high as $1,250.000/MMBtu on Wednesday. It averaged $1,192.855, up $248.080 day/day. Prices at Enable East, also in the Midcontinent, traded as high as $500.000 and averaged $428.640, up $128.640.

Benchmark Henry Hub climbed $6.650 to average $23.605.

Midwest prices, however, fell by the triple-digits, as did some Rockies pricing locations. East Coast prices also started to crumble. Transco Zone 6 NY next-day gas averaged $13.495, down $1.500 from Tuesday.

“To state the obvious, prices are a function of both demand and supply, and this Arctic event has been a doozy for both sides of that equation,” said RBN Energy LLC analyst Sheetal Nasta.

Variables In Play

Futures prices also remain subject to strongly conflicting forces, according to EBW. On one hand, record amounts of production are offline, the firm said.

Bloomberg and NGI data showed output dipping to 72 Bcf/d by Wednesday, “a level not seen consistently since January 2017,” according to NGI Director of Strategy & Research Patrick Rau.

For perspective, Lower 48 output was above 90 Bcf/d just 10 days ago on Feb. 5.

Wood Mackenzie has seen a similar stark decline in production, though it said the figures could be understated, and revisions are possible.

“We don’t believe this large decline in production is purely freeze-off related, although freeze-offs play a major role,” Wood Mackenzie said.

The firm said there could be a fair amount of gas in the Permian and on intrastate pipelines that is being delivered directly to meet local demand, rather than showing up as production in its models. Meanwhile, gas pipelines are still reeling from the cold, with many operational flow orders and forces majeure still in place.

RBN analyst Jason Ferguson said Permian output was down to around 3 Bcf/d, off from almost 11.5 Bcf/d last week.

Meanwhile, exports, both to Mexico via pipeline and in the form of liquefied natural gas (LNG), have been heavily impacted by the reduction in supply.

Mexico’s Centro Nacional de Control del Gas Natural (Cenagas), operator of the Sistrangas national pipeline grid, declared a systemwide state of critical alert on Tuesday until further notice, citing scarce gas supplies from Texas due to the inclement weather. The alert came amid rotating blackouts enacted by power grid operator Centro Nacional de Control de Energía for the same reason.

Mexico relies on U.S. imports for 70-80% of its gas supply needs, and gas-fired plants account for about 60% of power generated in Mexico.

The situation across the border may become more dire given Texas’ temporary ban on outside gas sales.

Already, LNG terminals in Texas slashed demand after Abbott asked exporters to curb operations in order to help ERCOT avoid an even more dire system outage. Freeport LNG shut down the second and third production units at the facility on Tuesday, the company said in a regulatory filing. The first train was shut on Monday because of freezing conditions that affected a pretreatment facility.

Cheniere Energy Inc. also is said to be diverting vessels away from Corpus Christi to Sabine Pass in an effort to curb electricity use. Meanwhile, power was restored at Cameron LNG in Hackberry, LA, which is working to ensure it can safely restart operations.

NGI data showed LNG feed gas deliveries jumping more than 4 Bcf day/day to around 6.3 Bcf by Wednesday. On Tuesday, feed gas volumes sank to historic lows of 2.20 Bcf after late-cycle nominations.

Industrial sector demand also has fallen sharply, according to Wood Mackenzie. The firm said its sample of industrial users pulling gas directly from interstate pipelines has fallen below levels seen during the worst of the pandemic restrictions last April. “Our sample of industrial demand makes up around 27% of total industrial demand.”

Several large refineries cut gas use by more than half, Wood Mackenzie said, including Saudi Arabian Oil Co.’s (aka Saudi Aramco) Motiva Port Arthur facility and Chevron Corp.’s Pascagoula refinery in the Gulf of Mexico (GOM). Others in the Midwest also have reduced usage.

Major methanol producers in the GOM, as well as several large nitrogen fertilizer manufacturers, also have lowered their gas intake, according to the firm. Methanol and nitrogen fertilizers use natural gas as a feedstock, which drives their massive consumption.

Thaw Coming

Not a moment too soon, forecasts are calling for the dangerous cold to eject from the central United States and Texas beginning Thursday and continuing through Sunday.

NatGasWeather said “the worst of the coldest temperatures have passed as conditions gradually moderate in the days ahead.” The forecaster said rather than lows plunging as low as minus 20 degrees, the region could see overnight temperatures from sub-zero to the 30s.

There is some discrepancy in the Global Forecast System model and its European counterpart, which is “neutral to potentially a touch bearish,” according to the most recent run.

“But we do caution, the start of March needs close watching because it wouldn’t take much of a colder trend for the pattern to quickly look more intimidating, although any further milder trends and the pattern would take on a rather bearish stance,” NatGasWeather said.

In the very near term, Nymex futures may take direction from government storage data. The Energy Information Administration (EIA) is scheduled to release its weekly inventory report at 10:30 a.m. ET on Thursday.

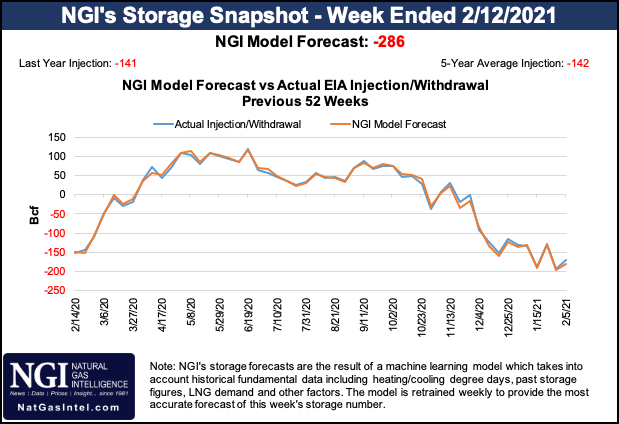

Ahead of the report, major surveys showed draws steeper than 200 Bcf, which would be the largest pull of the season so far. Reuters polled 18 analysts, whose estimates ranged from withdrawals of 288 Bcf to 202 Bcf, with a median decrease of 250 Bcf. Wall Street Journal estimates were in the same range, with a median of 251 Bcf decline. Early indications from a Bloomberg poll produced a tighter range, with a median draw of 245 Bcf. NGI projected a 286 Bcf pull.

Last year, the EIA recorded a 141 Bcf during the same week, while the five-year average withdrawal for the period stood at 142 Bcf.

The EIA said inventories fell by 171 Bcf in the week ended Feb. 5, which was 9 Bcf below year-ago levels and 152 Bcf above the five-year average. Stockpiles have remained above the five-year average since the start of 2020, but the multi-week stretch of stout withdrawals in the coming weeks are seen erasing the overhang.

"selling" - Google News

February 18, 2021 at 06:59AM

https://ift.tt/3bf26GP

Natural Gas Market Chaos Continues as Texas Governor Bans Producers From Selling Outside State - Natural Gas Intelligence

"selling" - Google News

https://ift.tt/2QuLHow

https://ift.tt/2VYfp89

Bagikan Berita Ini

0 Response to "Natural Gas Market Chaos Continues as Texas Governor Bans Producers From Selling Outside State - Natural Gas Intelligence"

Post a Comment