- Cash is still in demand, but payments are increasingly shifting to digital instruments.

- Consumers are embracing faster, more efficient and more convenient forms of payment.

- The number of bank branches and ATMs is decreasing in advanced economies.

The digital revolution is reshaping payments. Consumers are increasingly shifting from physical to digital instruments. The shift is promoting efficient, faster and more convenient payments. To investigate these trends, this commentary looks at the payments landscape through the lens of the Committee on Payments and Market Infrastructures (CPMI) Red Book statistics.

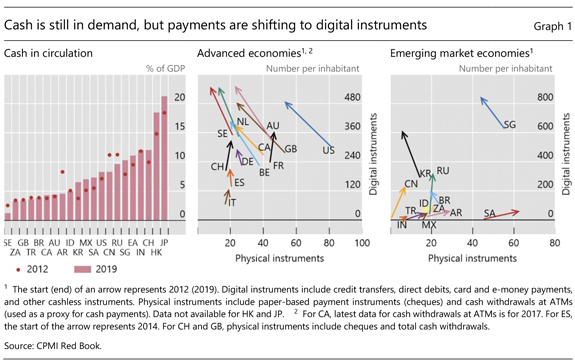

While digital payments are growing rapidly, cash and, in some jurisdictions, other paper-based payments such as cheques remain important payment instruments. In more than half of the CPMI jurisdictions, "cash is still king" and its circulation continues to grow (Graph 1, left-hand panel).The largest ratio to GDP is in Japan and Hong Kong SAR (21% and 18% of GDP, respectively). In contrast, cash has declined by 3 percentage points of GDP in China since 2012. Sweden continues to be the model of a "cash-lite" society, with a cash-to-GDP ratio of 1%. From 2012 to 2019, the period under review, the value of banknotes in circulation relative to GDP increased by 14% while the ratio of coins to GDP fell by roughly 5% across CPMI countries.1

In the same time frame, more than half of the CPMI countries have experienced a decline in the use of physical payment instruments and a rise in the use of digital payments (Graph 1, centre and right-hand panels). The former include both cash (with cash withdrawals at automated teller machines (ATMs) used as a proxy) and cheques, while digital payment instruments include direct debits, credit transfers, and card and e-money payments. The average number of digital payments in CPMI jurisdictions increased from 176 per inhabitant in 2012 to 303 per inhabitant in 2019. For advanced economies the use of physical payments declined on average by about 30% in the period under review, while for emerging market economies it continued to grow. In 2019, the most frequently used digital instruments were card payments, with people in CPMI countries making debit and credit card purchases worth USD 15 trillion a year.

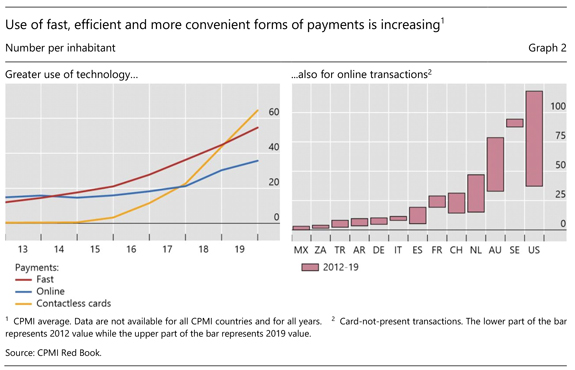

The shift to digital goes beyond debit and credit card payments. Digital technologies allow consumers to use efficient, faster and more convenient payment instruments (Graph 2, left-hand panel). The number of fast payment2 transactions per person continues to increase, as fast payment systems are rolled out in more and more CPMI jurisdictions.3 In period under review, payments with contactless cards, and remote (eg card-not-present) payments became more popular.4 On average, residents in CPMI jurisdictions5 made 65 contactless card transactions per person in 2019, which is about three times more than in 2017. When it comes to online payments, the divergence in the growth rate is noticeable (right-hand panel). In countries such as the United States, Sweden and Australia, where e-commerce revenue is more than 1.5% of GDP,6 residents make more than 75 online payments per person annually. At the low end are residents in South Africa and Mexico, with fewer than five online payments per year.

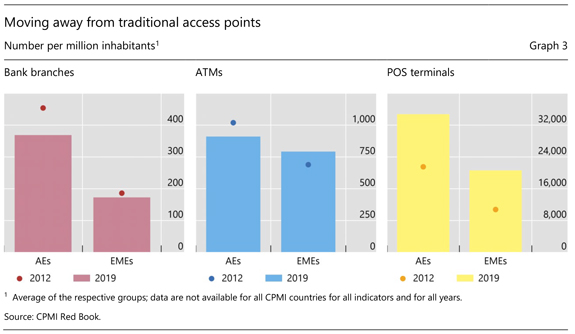

New technologies are also shaping the access points to payments. As digital and mobile payments take off, the network of traditional access points becomes less dense, while store tills are substituting for bank branches and ATMs to some extent by allowing customers to deposit/withdraw cash from their bank accounts (as debit card transactions).7 Across CPMI jurisdictions, bank branches per million people declined by about 13% in 2012-19 (Graph 3, left-hand panel). A similar decline is seen in the total number of ATMs per million people in CPMI advanced economies (centre panel). In the same period, the density of point of sale (POS) terminals almost doubled, with 34 POS terminals per thousand people in advanced economies and 20 in emerging market economies (right-hand panel).

While the 2020 Red Book data will not be available for some time,8 the Covid-19 pandemic is likely to accelerate the current trends towards digital payments outlined in this 2019 Red Book data summary. Several studies have already looked, or are looking, at the impact of the pandemic on payments.9 Social distancing, public concerns about the viral transmission from cash, and the surge in e-commerce activity are accelerating the use of digital payments, and may have a structural impact going forward.

* This analysis was prepared by Codruta Boar and Róbert Szemere.

1 Unlike with banknotes, the main function of coins is considered to be as a means of payment, not as a store of value.

2 CPMI, Fast payments - enhancing the speed and availability of retail payments, November 2016, defines fast payments as those where the transmission of the payment message and the availability of the "final" funds to the payee occur in real time or near real time on as close to a 24/7 basis as possible.

3 For more details, see M Bech and J Hancock, "Innovations in payments", BIS Quarterly Review, March 2020, pp 21-36.

4 For more details, see Bank for International Settlements (BIS), "Central banks and payments in the digital era", Annual Economic Report 2020, Chapter III, June 2020; and R Auer, J Frost, T Lammer, T Rice and A Wadsworth, "Inclusive payments for the post pandemic world", SUERF Policy Note, September 2020.

5 Data available for six countries: CH, FR, ID, NL, RU, TR.

6 Statista estimates.

7 Data available for AU and ZA. In 2019 the value of cash withdrawal at POS terminals were AUD 21 billion and ZAR 126 billion respectively.

8 The 2020 data will be available in the 2021 release of Red Book statistics.

9 BIS (2020), op cit; R Auer, G Cornelli and J Frost, "Covid-19, cash and the future of payments", BIS Bulletin, no 3, 3 April 2020; and Auer, Frost, Lammer, Rice and Wadsworth (2020), op cit.

"payment" - Google News

November 04, 2020 at 04:25PM

https://ift.tt/2TP3Kqz

Payments go (even more) digital* - bis.org

"payment" - Google News

https://ift.tt/3bV4HFe

https://ift.tt/2VYfp89

Bagikan Berita Ini

0 Response to "Payments go (even more) digital* - bis.org"

Post a Comment