martinrlee

Research Brief

Today's analysis focuses on a household name when it comes to sending & receiving money, that has been around since the 19th century.

Western Union (NYSE:WU) recently had its Q2 2023 earnings release date in late July, and I will take a moment to pick apart some of that data.

A few key points about this company from its official website: roots in 1861 as a telegraph company, becomes publicly traded in 2006, network of 500K+ retail agents globally along with digital options for money transfer.

In fact, I personally "simulated" an online transfer on their website and was impressed with the ease of use & simplicity of the platform, that seems to earn transaction fees on each transfer.

Rating Method

I look for dividend opportunities & value plays among tech, financials, & innovation stocks. My rating analysis is broken down into rating 5 categories:

Valuation, Dividend Yield, Net Income Growth, Capital & Liquidity, Share Price.

To earn a "hold" rating the stock has to win on 3 of the 5 categories, and 4 out of 5 to earn a "buy" rating.

Valuation: Recommend

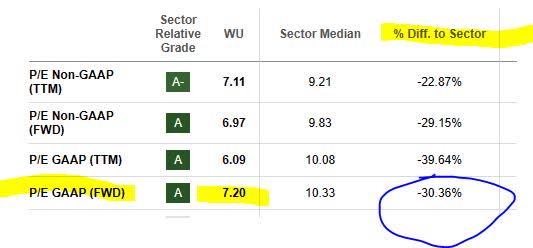

It is clear why this stock got an "A" grade from Seeking Alpha when it comes to forward P/E ratio. A price-to-earnings of 7.20, it is over 30% below its sector average on this metric, as the sector hovers at just over 10x price to earnings.

Western Union - P/E ratio (Seeking Alpha)

Things are not so rosy when it comes to price-to-book value. It earned a grade of "F" with a P/B of 5.97, which is a whopping 456% higher than the sector average that is just over 1x price to book.

Western Union - P/B ratio (Seeking Alpha)

After doing some digging, it seems that it is not unique to Western Union, however, and two of its peers are also overvalued on price to book. Consider that payment processor Euronet Worldwide (EEFT) has a forward P/B ratio that is around 152% higher than sector average, and Nuvei Corp (NVEI) has a forward P/B that is 100% above the industry average.

So in this case, I would recommend this stock on the basis of its price-to-earnings valuation which is attractive, even though I would like to see a much lower price to book valuation closer to somewhere between 1.0 and 1.05, as paying almost 6x book value seems high if one were only to look at that metric alone.

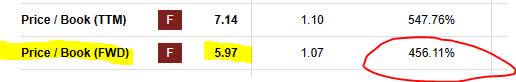

Dividend Yield: Recommend

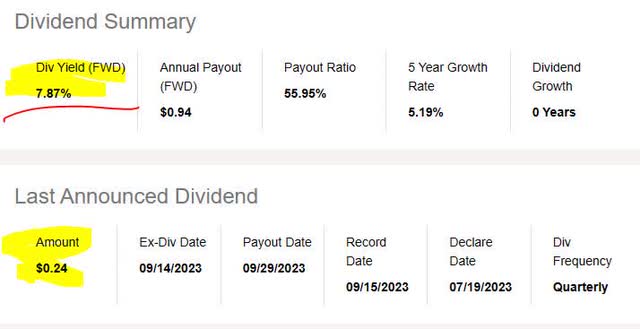

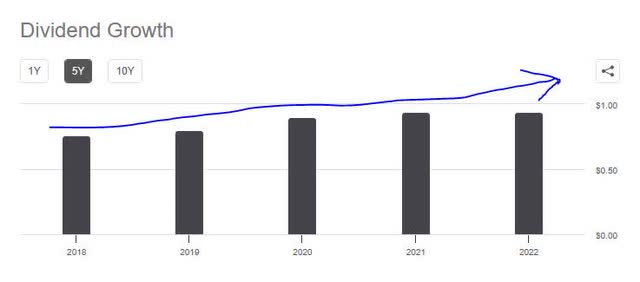

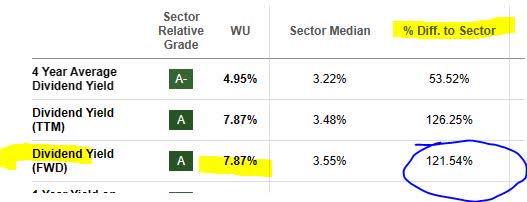

Yes, I had to look a few times to confirm, but this stock indeed pays close to 8% dividend yield.

As of August 5th, it has a yield of 7.87%, a dividend of $0.24 per share, and pays quarterly. In fact, one can take advantage of the next ex-date coming up on September 14th.

Western Union - dividend yield (Seeking Alpha)

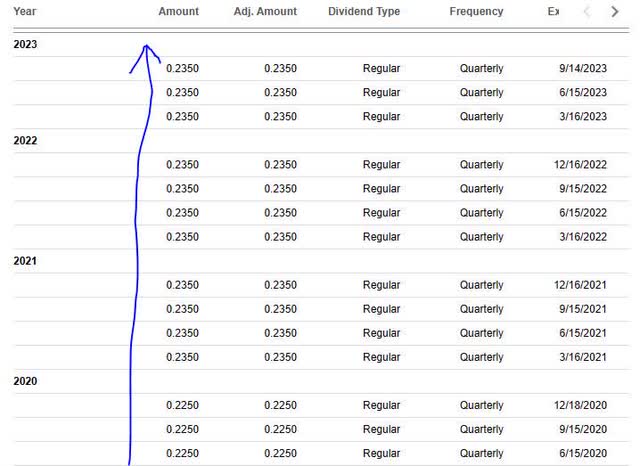

In addition, it has a history of dividend growth over the last 5 years, according to the chart below. It went from an annual dividend of $0.76 in 2018 to $0.94 in 2022, a 24% increase.

Western Union - dividend 5 year growth (Seeking Alpha)

Also, the quarterly payments have been steady and increasing since 2020, without being cut or interrupted once. This has potential to create recurring income for a dividend investor looking for quarterly income.

Western Union - dividend history (Seeking Alpha)

Considering that the sector average dividend yield is somewhere around 3.5%, this stock is now over 121% above it sector average when it comes to dividend yield, highly impressive.

Western Union - dividend yield vs sector average (Seeking Alpha)

Needless to say, it's a no-brainer in my opinion that this stock should not only be recommended as a dividend quick pick but also is among the top 3 dividend yields I have discovered so far this year.

Net Income Growth: Not Recommended

I am looking to see YoY growth trends in net income for this company. At first glance at its income statement, there was a YoY decrease in both net income and earnings per share after most recent results:

Western Union - net income & EPS growth YoY (Seeking Alpha)

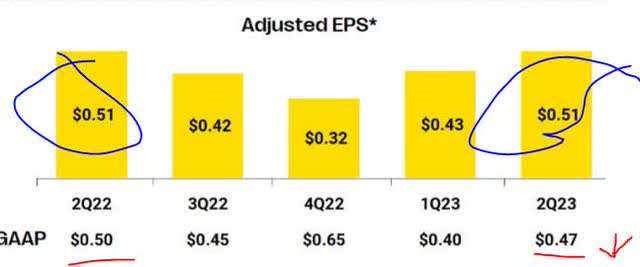

In addition, its adjusted earnings per share was flat YoY while on a GAAP basis it fell a few cents:

Western Union - adjusted EPS (Western Union - q2 presentation)

In trying to make sense of what were the driving forces behind this drop, the company's Q2 commentary shed some light into this situation:

The year-over-year decrease was due to lower operating profit, including costs related to the Company's operating expense redeployment program in the current period.

Nevertheless, I am not seeing a long-term net income growth trend when looking at the income statement over the last year, but rather it is quite choppy.

For now, I do not recommend this stock on the category of YoY net income growth, an important metric that I consider when evaluating a company's ability to manage both revenue and expenses successfully over several quarters.

Capital & Liquidity: Recommend

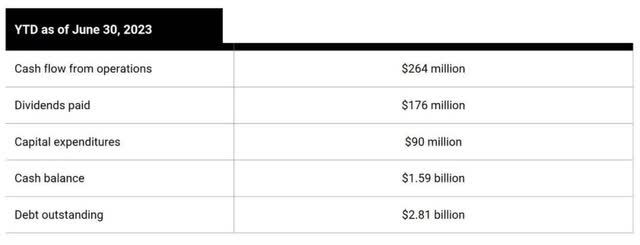

Analysts and investors care about whether a business will continue to be solvent, so let's look at some key financial metrics from Western Union in their Q2 results presentation:

Western Union - capital metrics (Western Union - Q2 presentation)

On a positive note, it has a positive cashflow from operations of $264MM, was able to pay out $176MM in dividends, and boasts a cash pile of $1.59B, which is not small peanuts.

Next, I am looking at whether this firm consistently has positive equity, which it does, and a sign that it manages its balance sheet effectively:

Western Union - total assets (Seeking Alpha)

Western Union - total liabilities (Seeking Alpha)

Western Union - total equity (Seeking Alpha)

From the metrics above, you can see that this firm has over $8.4B in assets, $7.8B in liabilities, and positive equity of 627MM, along with a longer-term trend of positive equity.

Keep in mind this is not a bank, so it is not using metrics like CET1 ratio and liquidity coverage ratio, hence we can go just by the traditional balance sheet in this case.

I think the capital & liquidity outlook is good for this stock at this time.

Share Price: Recommend

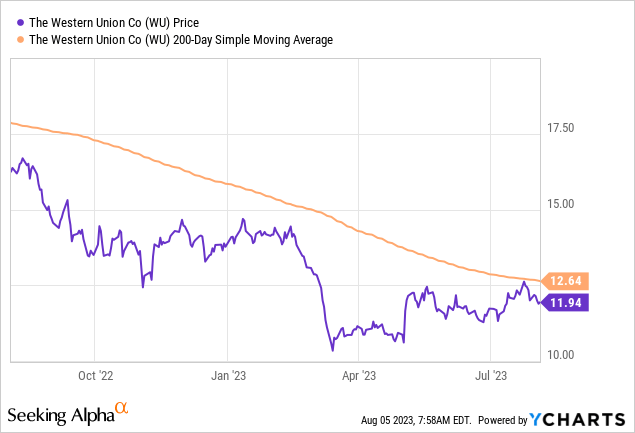

As of August 5th, after the markets closed for the week already, the shares are at $11.94, which is around 5.5% below the 200-day simple moving average:

This share price is a recommend because it falls close within my trading range of 5% below / above the 200-day SMA.

My investing idea calls for tracking the share price vs. the 200-day moving average. Here is an example of a simulated trade using this system:

Western Union - trade simulator (Albert Anthony & Co.)

In this investing simulation for Western Union stock, 100 shares are bought at the current share price of $11.94, held for a timeframe of 1 year, earning the full year dividend income, and achieving a dividend yield of 8.04%. Then, they are sold at 5% above the current 200-day moving average, to achieve a capital gain. Total return on the money invested is 19.18%, not too shabby in my opinion.

This idea depends of course on the moving average working in our favor, which sometimes it does not, and could lead to unrealized losses. This is why I have taken the "long-term" approach to this stock since over a longer term I think eventually it will overcome any paper losses and rebound back to a good selling price.

Of course, that opens the door to topics like capital gains taxes and tax on qualified dividends, which I do not discuss in these articles, but nevertheless it is something my readers should research further with their tax advisor. This section is more about adopting a structured framework for thinking about this stock and how it could benefit a portfolio.

Ratings Score: Buy

Today, this stock won 4 of my 5 rating categories and earned a buy rating, which is in line with the consensus from Seeking Alpha analysts but is more bullish than the sentiment from Wall Street and the SA quant system, as shown below:

Western Union - ratings consensus (Seeking Alpha)

One thing that kept it from being a strong buy rating was the lack of YoY net income growth.

Risks to my Outlook: Recession Risk

A risk to my modestly bullish outlook on Western Union is that a larger recession takes place in 2023 and 2024, thereby reducing payment volumes, and impacting transactions revenue for Western Union since it depends largely on payment transactions.

This risk was highlighted back in a Feb. 2023 article by The Payments Association:

In a typical recession, payments providers expect lower volumes leading to less profitability as customers scramble to save more. However, there is a debate among industry experts on how much a recession would really affect customer behaviour.

However, that article also goes on to add some speculation to the topic, not predicting in any certain terms that this scenario will indeed take place:

Consensus among most industry experts is that a 2023 recession will not see pandemic-like plummeting payments volumes; however, this prediction is based on patterns over recent months. The real impact on consumers and industry is hard to predict and will likely be felt only in 2024 or even 2025.

My counterargument to this risk is also tied to lack of recession certainty. In fact, just this week a CNBC article gave tailwind to those who do not expect a major recession to occur.

Predictions that a recession may be looming for the U.S. economy have so far not come to fruition. Now, some experts are backing off the prediction altogether, including Federal Reserve staff economists.

Unemployment and other factors - growth in economic activity, wage and price pressures in the "right direction" - prompted Bank of America to reassess its previous calls for a mild recession in 2024.

Hence, I think Western Union will be OK for the immediate future as far as impact to payment transactions volume.

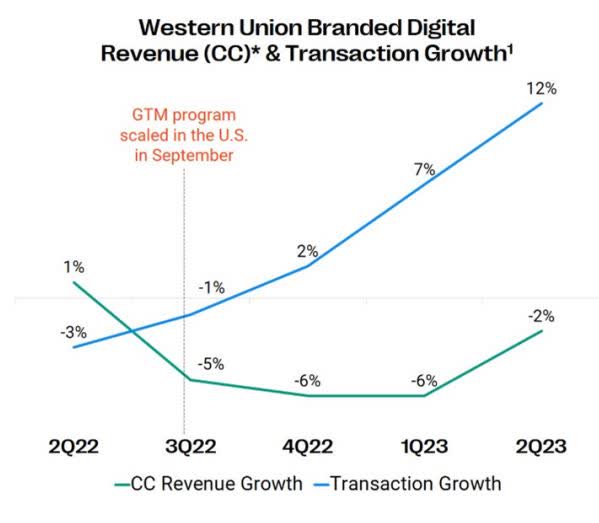

One segment I think is in its favor is online transactions, perhaps more so than retail alone, and the following graphic shows an uptrend in transaction growth from their branded digital segment:

Western Union - digital growth (Western Union - Q2 presentation)

Analysis Wrap Up

Here are the key points we went over today.

Positives: dividend yield higher than sector average, share price 5% below 200-day SMA, strong capital & liquidity position, P/E ratio lower than sector average.

Headwinds: YoY net income growth drop.

Risks of payment volumes decreasing due to a recession are low, considering the evidence from many economists that does not indicate a larger recession looming.

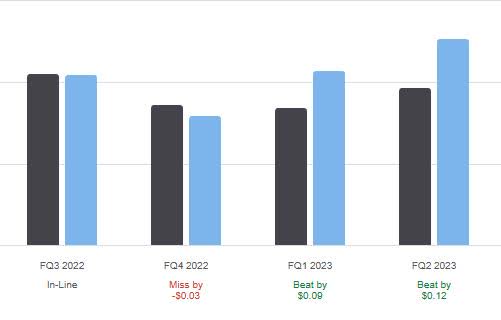

In conclusion, I think in the next quarterly results in a few months this stock will meet or beat estimates, as it has done in three of the last 4 results. I am calling for an earnings beat of $0.05, which is the average of the last 4 earnings beats.

Western Union - earnings beats (Seeking Alpha)

"payment" - Google News

August 08, 2023 at 05:43AM

https://ift.tt/JP2sCS8

Western Union: Buy A Payments Industry Leader With 8% Dividend Yield (NYSE:WU) - Seeking Alpha

"payment" - Google News

https://ift.tt/UM1DEHq

https://ift.tt/RHhBF2f

Bagikan Berita Ini

0 Response to "Western Union: Buy A Payments Industry Leader With 8% Dividend Yield (NYSE:WU) - Seeking Alpha"

Post a Comment